This Best Debt Plan Has 7 Actionable Steps to Attack Your Debt Starting TODAY!

Debt consolidation loans help borrowers combine multiple high-interest debts into a single payment with a better interest rate, saving you a bunch of money on interest paid!

When you have bills to pay, it’s easy to lose track of them and miss a payment. If you’re struggling to keep up with your debt, or if you just want to save money on credit card bills, consider the #1 debt consolidation plan of 2025.

Here's how it works:

Step 1: Go to the official website and select "Pay off debt"

(#3) Consolidate Your Debt Into ONE Lower Monthly Payment (Potentially With a Better Interest Rate)

Struggling to get ahead because interest keeps holding you back? Use our proven “debt shortcuts” below and start paying off your debt more quickly. (Pro tip: Bookmark this page so you can come back later...)

Did you know that old windows are one of the biggest factors that drive up your home electricity bills?

This new website is a game-changer for homeowners looking to replace their windows without breaking the bank. They bring the best, fully insured vendors in your area into a bidding war to win your business, ensuring you get the lowest possible price without compromising on quality.

Score massive savings on your window replacement by securing special rebates, discounts, and incentives that are available in your area.

If you meet these 2 requirements, you may be eligible for HUGE savings:

1. Own a home in an eligible zip code

2. Have windows that are over 5 years old...

(#6) Save a FORTUNE On New Energy Efficient Windows

Banks will NOT tell you this... but they can't stop you from doing it either...

Still unknown to many is a brilliant insured refi plan called the FHA Cash-Out Plan (FaCOP) that could benefit millions of Americans and give them up to $185,000 in cash to use however they'd like!

You could bet that the banks aren't too thrilled about losing all that profit from high interest loans and might secretly hope you don't find out before this program ends for good.

Americans can use this towards paying down high interest debt and can use the excess for home renovations, kids tuition, funding businesses and even taking vacations.

Best part... There is NO COST to see if you qualify.

(#1) Borrow From Your Homes Equity & Pay Down High Interest Debt!

You could be throwing away THOUSANDS on expensive home insurance every year...

Your home is one of the largest financial investments you'll make in your entire life... But it's also an investment that's vulnerable to risk making it very important to have insurance in place. The only problem is that home insurance rates are getting SPENDY!

BUT... Thanks to this new home insurance comparison website homeowners can save up $1K from a quick 3 minute quiz. And you can throw those savings at your high interest debt!

(#5) Americans Are Ditching Their Spendy Home Insurance & Doing This Instead... (Save up to $1K/year)

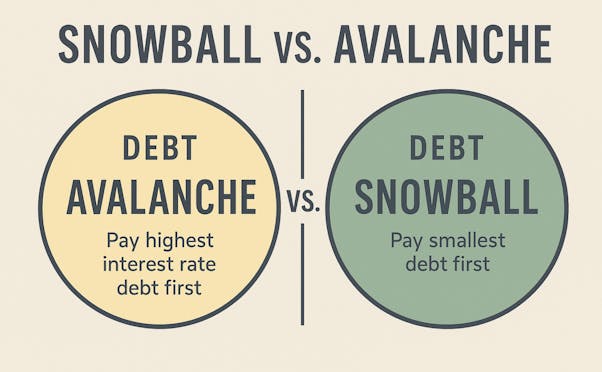

Snowball Method: Focus on your smallest debt first. Knocking it out quickly gives you an early win and momentum to keep going.

Avalanche Method: Tackle the debt with the highest interest rate first. This strategy saves you money over time by cutting down on interest charges.

(#4) Try One Of These 2 Most Common & Best Debt Payoff Plans!

Audien is the world’s first wireless charging hearing aid for less than $100. This is because the FDA finalized a rule that approves the sale of "over-the-counter" hearing aids through online retailers.

Not only are these state-of-the-art hearing devices perfectly suited for mild to moderate hearing loss, they’re also incredibly easy to use (just pop them in!) and last for a full day on a single charge. Best of all, they’re designed to disappear into your ears... so nobody has to know you’re using them! Audien's hearing aids have been featured in Senior Living and Forbes. These hearing aids come with a 45-day money back guarantee, 1-year warranty, and lifetime support.

So if you're currently using expensive hearing aids this could be another money saver for you.

(#7) Instead of Paying Thousands on Hearing Aids, Try This Instead...

It's a fact, we all use too much soap when we wash our hands. This is why we should all wrap an elastic band around our soap dispensers. This is a great way to be careful with your soap usage and to not be wasteful...

Just wrap a rubber band around your soap dispenser so you don’t squeeze all your soap away. This will also save you some good money because you won’t run to the store weekly for a new bottle.

(Bonus) Easiest Way to Save Money on Soap

That's all folks! If you know anyone else struggling with high interest debt, feel free to send them this link: bestdebtplan.com

Driving without insurance is illegal - BUT switching to a smarter option isn't...

Drivers are paying less for BETTER coverage using this new website. The average driver could get up to $710/yr back in savings! Here's how you can save big in just a minute or two...

(1) Go to CoverageHero.com - a 100% free website that makes insurance companies compete for your business which drives down the price

(2) Answer a few questions about your vehicle

(3) Check your savings... And put those savings towards your high interest debt!

That's it... It's insanely simple & free to use so it's a no-brainer for any American with a vehicle.

(#2) Cancel Your Car Insurance TODAY...

Step 2: Fill out some basic information (takes like 3 minutes).

Step 3: And just like that you'll be able to consolidate your debt into one monthly payment and be one step closer to a debt free life!

Terms of Service | Privacy Policy | Disclaimers | Contact Us

Trademarks utilized on our website belong to their respective owners and no implied or expressed endorsement of our website or services is intended. Through in-depth research and experienced editors, we provide feedback about products and services. We are independently owned, and opinions expressed here are our own. This page is an advertorial, and not an actual news article, blog or consumer protection update!

Copyright © 2025 bestdebtplan.com - All Rights Reserved